How A Financial Agreement Could Protect Your Investments

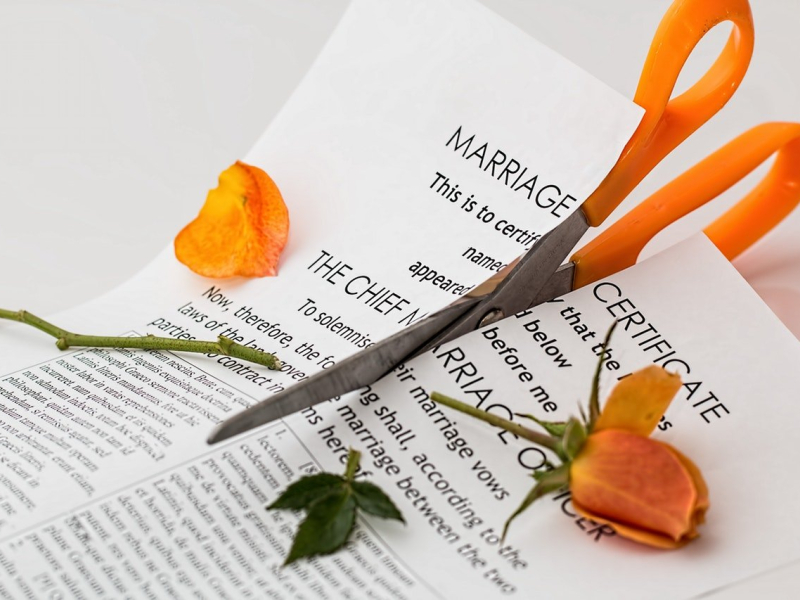

We work hard to to earn, invest and grow our wealth to live a comfortable life and to assist our family in the future. But what happens when your family dynamics change and the wealth you have accumulated for your family - for your children to invest - be

Our Strategic Partner, Samantha Lewis from Nolan Lawyers, advises that the best way to protect your wealth and your family’s financial future is by entering into a financial agreement now so you are prepared if sadly, your relationship should break down in the future.

How Could A Financial Agreement Help Me?

Planning for your future includes not only making the right investment decisions but also protecting those investments. A financial agreement can be thought of like an insurance policy - you may never need to use it, but it’s there for peace of mind. People take out life insurance, home and contents and various other insurances; an insurance policy for your future wealth is arguably no different.

Many people have heard of financial agreements in the context of people getting married in the American term of a 'pre-nup'. What many people do not know is that these agreements can be entered at all stages of a relationship, not only before, but during and after separation. This gives people the flexibility to manage their financial affairs based on their ever changing financial circumstances.

Like To Learn More?

If you are considering whether a financial agreement is right for you, contact Samantha Lewis, Accredited Specialist in Family Law from Nolan Lawyers on (02) 8014 5885.